Employers who pay the apprenticeship levy can now transfer apprenticeship service funds to multiple organisations to pay for their apprenticeship training and assessment

Employers who pay the apprenticeship levy can now transfer apprenticeship service funds to multiple organisations to pay for their apprenticeship training and assessment

Transfers have now been extended, so employers can make transfers to as many employers as they choose within their 10% maximum annual transfer allowance.

So how can you prepare for transfers as a levy-paying employer?

1. Look at your transfer allowance

Log into your apprenticeship service account and click on Finance, then Transfers. You’ll be able to see your transfer allowance.

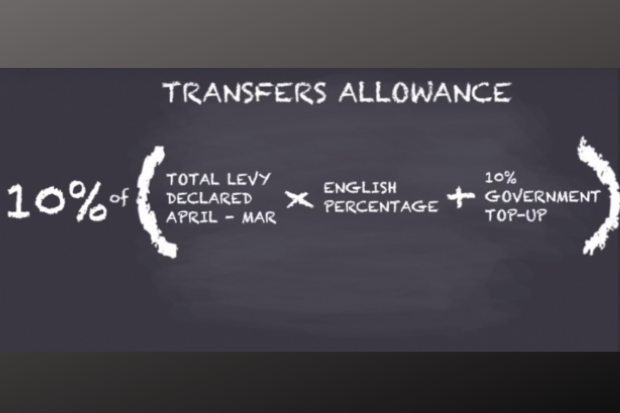

Your allowance is 10% of your annual funds, which will be calculated from the total amount of levy declared during the previous tax year.

Example

- The total apprenticeship levy declared to HMRC by Employer A in the 2017 to 2018 tax year was £500,000

- 90% of their wage bill goes to employees living in England so their ‘English percentage’ is 90%

- £500,000 x 90% = £450,000

- Add 10% government top-up. 10% of £450,000 = £45,000, so total is £495,000

- Employer A’s transfers allowance for 2018 to 2019 is 10% of the above total, so £49,500

This calculation will be done for you and you should now be able to see your 10% transfer allowance in your apprenticeship service account. You’ll then be able to set up a transfer from May and the employer receiving a transfer will be able to register and start adding apprentices to the service. Your first transferred funds can then come out of your account from June.

2. Consider the total costs of any apprenticeships you would like to support

As the sending employer you are responsible for managing the amount of funding that you transfer and for funding the whole cost of the apprenticeships you are supporting, up to the funding band maximum.

It is likely that the apprenticeships you fund will last longer than 12 months and they may start at different points in the year. The funding to pay for the apprenticeships will transfer monthly to the receiving employer to cover the exact training and assessment costs over the duration of the apprenticeship.

You can use the new transfers estimator tool in the apprenticeship service to help you with your planning.

Remember, in future financial years, if you continue to make levy declarations, you’ll have new transfer allowances.

3. Find a receiving employer

This can be any employer. You might want to choose an employer in your supply chain or sector, or perhaps you would like to support your local economy. It is your choice as long as the funding is being spent on apprenticeships.

The receiving employer can be a levy-paying employer as long as they are not sending a transfer. If you are sending a transfer you cannot also be in receipt of a transfer.

4. Have detailed conversations with your receiving employer

Discuss the number and type of apprenticeship standards that you could fund with a transfer and the total cost. You and the receiving employer might want to read Hire an apprentice for general information about employing an apprentice and use Find apprenticeship training to search for different types and levels of apprenticeship.

5. Read the funding rules

We have updated the apprenticeship funding rules to include the rules for transferring apprenticeship service funds (refer to paragraphs E173 to E207 for the rules on transfers).

6. Review and sign the new employer agreement

The employer agreement in the apprenticeship service has been updated to include transfers. Any employer that wants to send or receive a transfer needs to digitally sign the new employer agreement. You can view the agreement on GOV.UK as well as on the apprenticeship service.

As you may need to get approval from your organisation’s legal team or legal adviser, it makes sense to start reviewing the agreement now. Share the agreement with the receiving employer so they can review the document as well.

7. Agree the details and set up the transfer on the apprenticeship service

To send and receive a transfer, both employers will need to have an apprenticeship service account.

To make a transfer, the sending employer will need to make a connection with the receiving employer on the apprenticeship service. To do this, they will need the receiving employer’s account ID, which will be clearly displayed in their account.

Support your receiving employer in setting up their account by signposting them to our new bite-sized videos on using the apprenticeship service.

Checklist to get ready for transfers

- Read the introduction to transfers

- Watch this 3-minute video on transfers

- Read the funding rules for transfers

- Review the updated employer agreement

- Look at your transfers allowance in your account and use the transfers estimator tool

- Have conversations with potential receiving employers and share transfers online resources

To keep in touch, sign up to email updates from this blog or follow us on Twitter.

8 comments

Comment by Steve Smith posted on

When will the final funding rules be released?

Comment by Catherine Gilhooly posted on

Hi, you can see the funding rules here. They were published on 29 March.

http://www.gov.uk/government/publications/apprenticeship-funding-and-performance-management-rules-2017-to-2018

Comment by Manisha Gautam posted on

Can you confirm that employers who do not pay the apprenticeship levy can register for the apprenticeship service so that funds can be transferred from a levy paying organisation to a non-levy paying organisation?

Comment by Catherine Gilhooly posted on

Yes that is correct, but as explained in the blog, employers who do not pay the levy should not register for an account at this stage. We will put out communications on all of our channels such as @ESFAdigital on Twitter when the transfers functionality for receiving employers is in place.

Also, an employer receiving a transfer must have discussed and agreed the transfer with a levy-paying employer before registering on the service.

Comment by courtnay mcleod posted on

When will levy paying employers be able to transfer to more than one employer, and will there be a maximum number of organisations that one company can transfer to? Thanks

Comment by Catherine Gilhooly posted on

To test the new functionality of transfers on the apprenticeship service, we have started with a temporary cap so that levy-payers are able to make transfers to one employer. This is a short-term measure so that we can test the end to end process works for users, from making a connection, setting up apprentices and making payments to the training provider.

We cannot provide a timescale for when the cap will be lifted as it is dependent on us being able to monitor how the process is working. Again, we cannot say at this stage whether there will be a maximum as this will in part be dependent on the level of demand within the system and feedback from employers.

Comment by David Dawud posted on

Hi I am small employer. I need to take on apprentice I have taking on apprenticeship for five years now.

How can I find a levy -paying employer that is able to transfer funding

Comment by Catherine Gilhooly posted on

Thank you for your question and interest in receiving a transfer to support your continued apprenticeship programme.

If you would like to receive a transfer consider speaking to levy-paying employers in your supply chain. You could also get in touch with an industry or regional partner (such as your local enterprise partnership) to see if they are working with any levy-paying employers that are looking to transfer some of their apprenticeship service funds.